Open An Account

Bank from anywhere with a deposit account in just a few simple steps.

Apply Online Today

We’re a Top SBA Lender in the Bay Area

Get the funds you need to move the needle with an SBA loan.

Learn More

What's the Story?

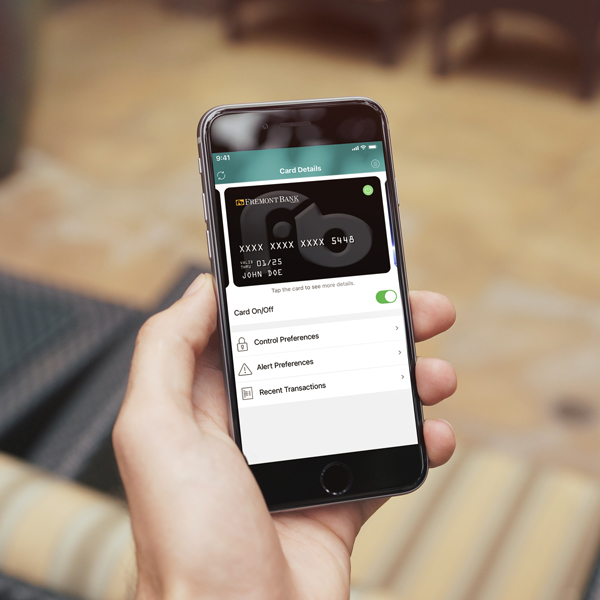

At Fremont Bank, the community comes first. And that’s the Fremont Bank Way.

Get to Know Us