Debit Card Fraud Alerts keep your account safe by sending you a text when a suspicious transaction is made on your account. You then have a choice to block the card if the transaction is fraudulent or unlock the card if it’s not. It’s that easy!

Do I need to enroll in SMS debit card fraud alerts?

No, all card holders will be automatically enrolled in this service.

Are fraud text alerts interactive?

Yes, you will now be able to respond to a text to inform the bank if the transaction is fraudulent or authorized.

What number [short code] will alerts be coming from?

The short code will be 37268.

What is the Fraud Center phone number listed in the text message?

The phone number is (833) 735-1897.

What happens if I respond "yes" to a transaction being authorized?

If yes, the card holder will receive a second text message informing them they may continue to use the card.

What happens if I respond "no" to a transaction being authorized?

If not, the cardholder will receive a second text message informing the client a block has been placed on the card and to call the Fraud Center immediately.

What if I don't respond to a text alert or do not use text messaging?

If a cardholder doesn't respond to a text message within 15 minutes, or if there is not a text-enabled phone listed, then a voice call will be attempted at all the phone numbers listed on the client's file.

Does Fremont Bank charge a fee for this service?

Fremont Bank does not charge a fee; however, message and data rates may apply based on your phone carrier.

Can I opt out of this free protection service at any time?

You may opt out at any time by replying stop to any alerts from your mobile device. If you opt out from interactive text alerts, you will continue to be notified by phone at the primary contact number we have on file.

What do I do if my mobile number changes?

Please contact Fremont Bank's Client Contact Center at (800) 359-BANK.

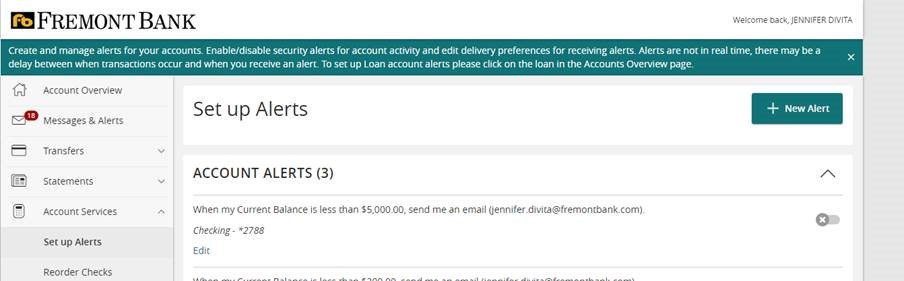

.png)

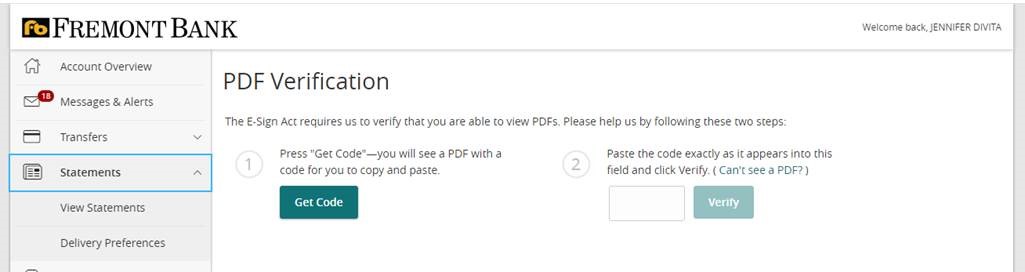

.png)

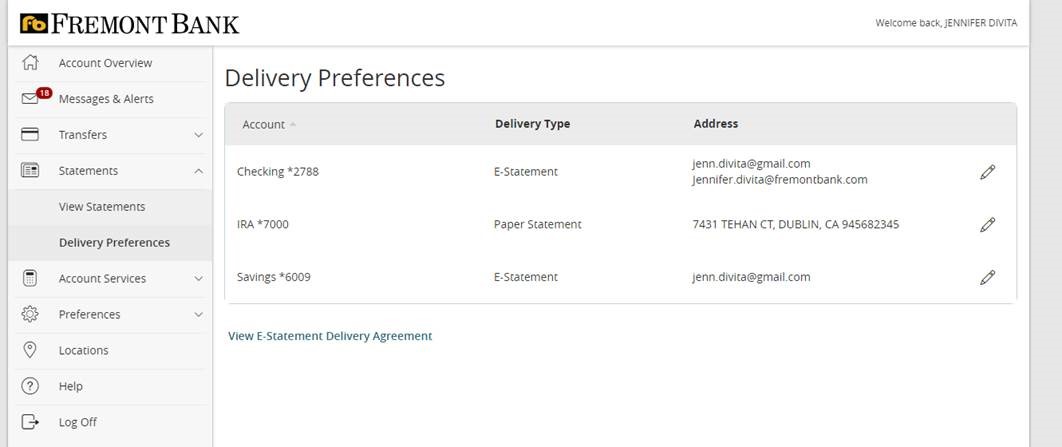

.png)

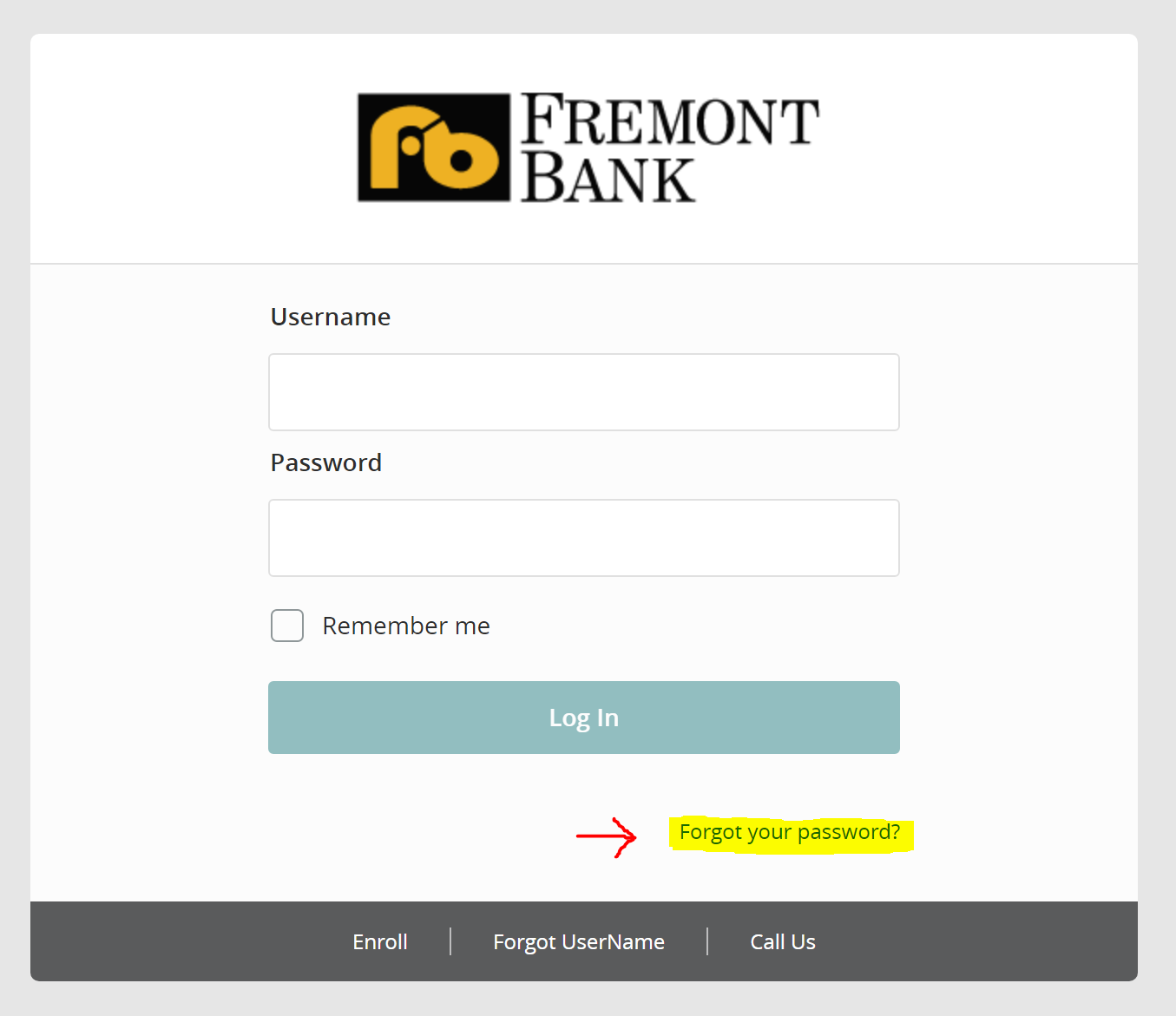

.png)